With the UK leaving the EU, from 1st January 2021 the status of UK registered vehicles within Europe changed overnight, with huge implications for customs, VAT and import duties.

Now a ‘third country’, UK registered vehicles (except those registered in Northern Ireland at the moment) have to go through one of three different import processes; which process depends on your specific circumstances.

Process 1 – You qualify for change of residence

If you are relocating to Spain and bringing your vehicle with you, you can apply for tax and import duty waivers via a Customs Agent.

Process 2 – Pay the import duty and VAT

If you are non-resident and/or don’t qualify under change of residence rules, then you will have to pay 10% duty and 21% IVA (VAT) on what Agencia Tributaria (Spanish tax office) calculates the vehicle is worth.

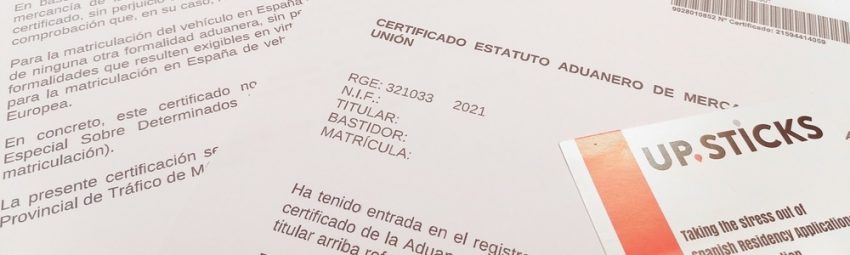

Process 3 – Apply for a Certificate of European Status for your vehicle

If you can prove that the vehicle was in Spain prior to the end of the Transition Period, you can apply for a “Certificado Estatuto Aduanero de Mercancías de la Union”, a customs document that certifies that your vehicle came into Spain under EU import conditions and therefore is not subject to third country import charges.

How Upsticks can Help

We specialise in the registration of vehicles in Spain – to find out how we can help you, Book a Call on our website for a no-obligation consultation call.

Check out our video on YouTube

The information in this article was current on the date published.