If you are planning to permanently relocate to Spain and apply to become a Spanish resident, you may well be bringing a vehicle with you as part of your “goods and chattels”.

While it’s quite well known that there are taxes to be paid when importing a vehicle, under certain circumstances, you may be able to get a waiver on one of these – the Special Registrations Tax.

What is the Special Registrations Tax on vehicles?

Special registrations tax, known in Spanish as Impuesto de matriculación (IEDMT), is applicable to all vehicle imports and is calculated using the vehicle’s age and emissions rating.

Are all imported vehicles subject to Special Registrations Tax?

NO – the good news is that not all vehicles are eligible to pay this tax – cars with low emissions are rewarded, so if your vehicle has an emissions rating of 120g/km or less then this tax doesn’t apply.,

Although the EU is pushing manufacturers to produce vehicles with less than 95g/km emissions, the Agencia Tributaria (Spanish tax office) decided not to reduce the tax-free limit this year. This is understandable when you consider that Spain earned a whopping 325 million + euros in Special registration tax payments in 2021.

What happens if your vehicle is over the magic 120 g/km emissions rating? Do you then have to pay the Special Registrations Tax?

Not necessarily. Even if your vehicle has higher emissions than the magic 120 g/km, you may still be able to get a Special Registration Tax waiver; however the conditions are much more strict.

Vehicle over 120 g/km? These are the conditions you must meet to get a Special Registrations Tax waiver

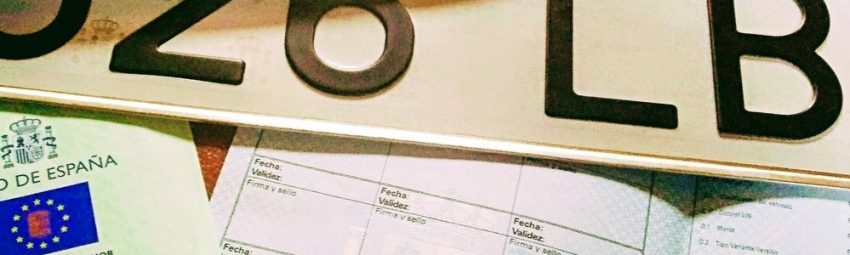

- You must have passed the ITV technical inspection and have the ‘ficha tecnica’ from the ITV in your hand

- You must have been the registered owner on the logbook for at least 6 months (they won’t accept a sales contract if the documents are not in your name)

- You must have taken your residency within the last 60 days

- You must have documents that prove where you lived before you came to Spain

How to prove where you have been living before you came to Spain.

What the Spanish Tax Office is looking for is basically an equivalent to the Padron Certificate – unfortunately, not every country in the world has a similar document or process.

For UK passport holders, by far the most effective way we’ve found of presenting a tax waiver is by contacting your local council in the UK and asking them to write a letter stating the dates you have been registered and deregistered on the electoral roll. You can also use work contracts, travel documents etc – anything that proves without a doubt that your case is undoubtedly a change of residence.

For non-UK passport holders/other third country nationals, then your Embassy or Consulate might be able to provide a stamped/certified letter confirming you’re no longer resident in your country of origin. EU passport holders do not need this additional paperwork.

All documents presented to the tax office will need to be translated into Spanish.

What happens once you’ve got your documents?

Once you have passed the ITV test, you will need to go to Hacienda and complete a form, depending on which situation applies to you:

No Special Registration Tax to pay – complete a Modelo 06

Pay Special Registration Tax form – complete a Modelo 576

If all this sounds a bit complicated, then give Upsticks a call. We specialize in vehicle registration and will make the process as stress-free and as smooth as we can. Book a Call with one of our specialists today.