When registering a vehicle in Spain, you will need to pay (or waive in some cases) the Special Registration Tax.

For the purpose of this article, we are going to look at cars and 4x4s (Turismos y Todo Terrenos in Spanish) on mainland Spain.

Motorbikes, bikes, motorhomes, historic vehicles, commercial/large vehicles and vehicles being registered in the Canary Islands are calculated differently.

IMPORTANT: for vehicles that do not have EU type documentation, with its specific coding, it’s very difficult to calculate the tax before the vehicle passes the ITV test.

What is special registration tax?

Special registration tax is an emissions-based charge which applies to all vehicles when registering them in Spain. This tax is calculated based on the age, emissions rating and a few other factors, and allows the vehicle to be registered with the DGT. In Spanish, the tax is called Impuesto Especial sobre Determinados Medios de Transporte or IEDMT for short.

Setting a base value for your vehicle

Every calculation starts with a number, and for this tax we need to work out the market value for your vehicle when it was sold in Spain. To do this, we refer to the Spanish Boletin Oficial del Estado (BOE).

A BOE isn’t just used to publish vehicle prices, it’s the way the Spanish Government publishes all laws in Spain. But for the purposes of this article, we are focusing on the annual publication of vehicle prices, in a BOE that’s issued in December every year.

You can read the latest relevant BOE here.

The BOE is in alphabetical order by manufacturer/make of vehicle, so we need to scroll through the document until we find the correct one.

Following the columns, you select as follows:

Column 1 – Marca – Make (Section D.1 of European vehicle documents)

i.e. Ford, BMW, Mercedes etc

Column 2 – Modelo-Tipo – Model & type (section D.3 of European vehicle documents)

i.e. 318 d Aut. (2008-)(E90)

Column 3 – Periodo commercial – dates commercially available, split into two sections, Inicio and Fin.

This refers to the start (incio) and end (fin) dates of when your make/model was available for sale in Spain. We need to match the date of first registration found on section ’I’ of European vehicle documents with these dates. For example, if your your vehicle was first registered in 21/02/2009 then it falls into the category matching inicio/start of 2008 and the fin/end of 2012 .

***Important note: the BOE refers to the manufactured dates in Spain, but the tax is calculated on the date of first registration NOT the manufacture date***

Column 4 – Datos ficha técnica – technical data, broken down into 5 sections:

C.C. (centímetros cúbicos) – engine size in cubic centimetres, (Section P.1 of European vehicle documents)

N.º de cilind – How many cylinders the vehicle has (Section P.1.1 of European vehicle documents)

G/D – fuel type – Gasolina (petrol) or Diesel. (Section P.3 of European vehicle documents).

The following sub categories have been added to this recently:

G/D/M/S/Elc: Gasolina/Diésel/Etanol+Gasolina o Bio/Gasolina GLP/Eléctrico.

GyE: Híbrido Gasolina Eléctrico.

DyE: Híbrido Diésel Eléctrico

P kW – (Potencia kilovatios) Power output in kilowatts. (Section P.2 of European vehicle documents)

Cvf – (potencia fiscal) fiscal power output. (Section P.2.1 of European vehicle documents). Only the Spanish seem to use this calculation (mainly for road tax purposes)

Column 5 – CV – Caballo de vapor – similar to horsepower in the UK (Section P.2.1 of European vehicle documents).

You can usually find this on the normal vehicle documents but it also figures on a Certificate of Conformity or ‘ficha tecnica reducida’

Once we’ve matched your vehicle using all or some of the parameters above, we come to to the final column – the all-important:

Column 6 – Valor euros – Value in euros – which is the base price for the calculation of the tax.

For the purpose of this article, we are going to take a base value of 10,000 euros.

Calculating the reduction for the age of your vehicle

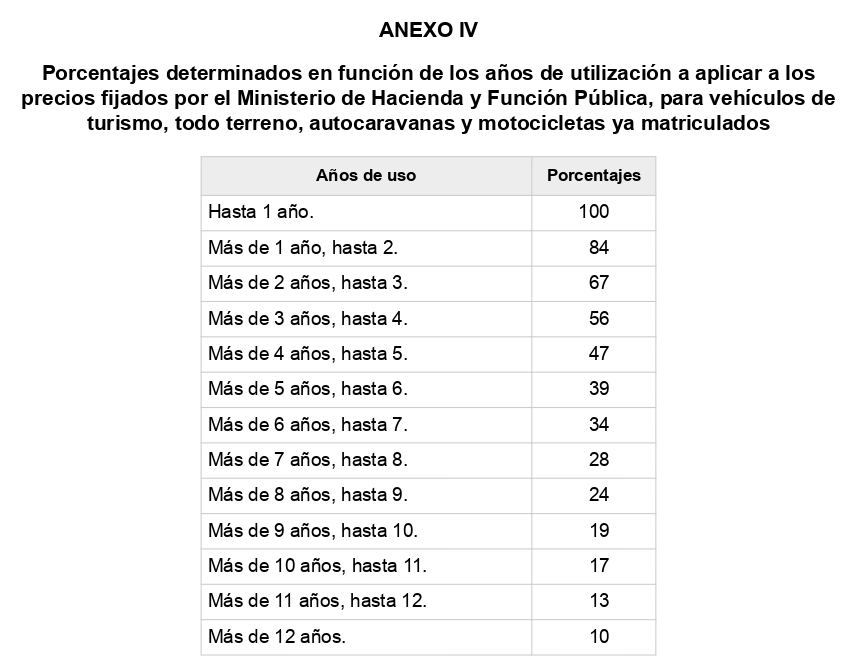

We now need to calculate what age related discount the vehicle will receive. This is done using a table published in the BOE below.

The age is calculated using the date of first registration found on section ’I’ of European vehicle, NOT the date of manufacture. If your vehicle was first registered on the 01/05/2015 then as of today’s date (20/06/2022), it would fall into the 7 – 8 year age bracket of 28%.

This means when using our example vehicle with a new price of 10,000 we would apply the following calculation:

10,000 x 28% = 2,800

Applying the tax coefficient

Now we need to calculate the tax coefficient using the equation:

1+ Tipo IVA + Tipo IEDMT

To understand the equation, we need to break it into two parts:

Tipo IVA – IVA means VAT in Spanish and refers to the VAT rate which was in place when the vehicle was first registered.

Here’s a list of the dates and VAT changes in Spain:

Date until % VAT

31/12/91 12

31/07/92 13

31/12/94 15

30/06/10 16

31/08/12 18

31/12/20 21

Our example vehicle has a date of first registration of 01/05/2015 so falls into the 18% rate, so the first part of our coefficient is: 18

Tipo IEDMT

The Impuesto Especial sobre Determinados Medios de Transporte (IEDMT) coefficient allows for a reduction due to the CC of the vehicle. This can be found on section P.1 of European vehicle documents and the calculations are:

Fuel CC Rate

Petrol -1600 7

Diesel -2000 7

Petrol +1600 12

Diesel +2000 12

Our example vehicle has a CC of 1589 so our rate is: 7

This means our 1+ Tipo IVA (18) + Tipo IEDMT (7) is: 1.25

So we take our previous calculation 10,000 x 28% = 2,800 and apply / 1.25

2,800 / 1.25 = 2240

Next we need to add a reduction for the emissions.

Calculating the reduction for emissions.

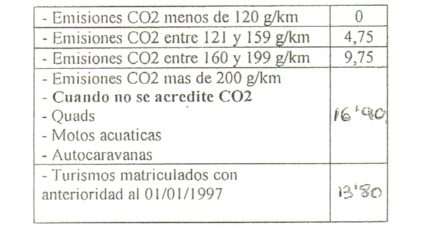

First, we need to find the emissions of the vehicle, (Section V.7 of European vehicle documents) and then use a table published by Agencia Tributaria (Hacienda – Spanish Tax Office) to calculate the reduction:.

The latest table is:

Our example vehicle has a g/km rate of 162 g/km, so our reduction is by 9.75%

So we take our previous calculation:

2,800 / 1.25 = 2240 x 9.75% = 218.40

The special registrations tax payable is therefore €218.40

Good to Know:

– Vehicles with less than 120g/km do not pay special registrations tax

– Vehicles registered before 01/01/1997 pay a standard rate of 13.80%

– Change of residence waiver – If you are taking residency in Spain you may be able to waive the tax. However, the tax office is very strict on the timing and paperwork of the tax waiver presentation. You can read more about it in this ARTICLE

How to pay the Special Registrations Tax

Online – If you have a Digital Certificate, or Cl@ve PIN you sign in online using this link to the Spanish tax office.

In person – Or you can book an appointment directly with your local Hacienda tax office here.

Via third-party – If you are using a professional company to help you with the matriculation of your vehicle, then they should be able to calculate and pay the tax on your behalf.

Find out more about how Upsticks can help register your car in Spain – click here

Spanish Car Registration

The information in this article was current on the date published.

Article last reviewed/updated 05.08.2022